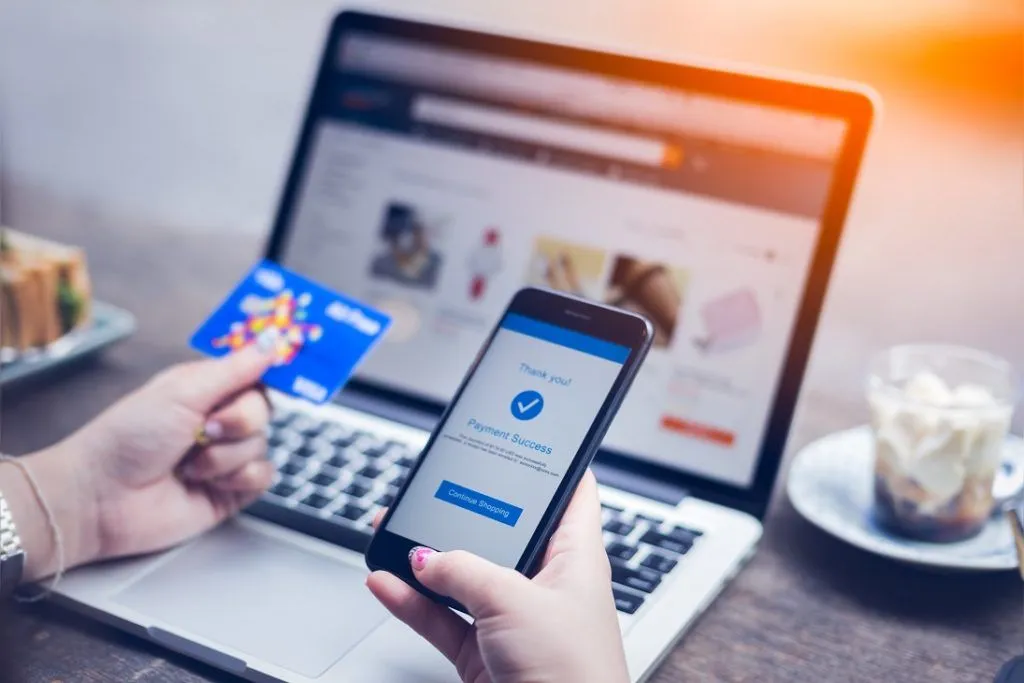

India is rapidly moving towards becoming a cashless economy, and payment gateways are playing a critical role in facilitating this transition. Online payment gateways have become an essential part of the digital ecosystem in India, with a wide range of options available to consumers and businesses alike.

According to a report by Statists, the digital payments market in India is expected to reach a transaction value of US$1.17 trillion in 2023. This growth is driven by the increasing adoption of digital payments in the country, especially among younger generations who are more tech-savvy.

In this blog, we have complied a list of india’s top 10 payment gateways for the upcoming year 2023. If you are a business looking for payment gateway services, this blog should help you get some perspective.

What is a Payment Gateways?

Payment gateway is a network through which your customers transfer funds to you. Payment gateways are very similar to the point-of-sale terminals used at most brick and mortar stores. When using a payment gateway, customers and businesses need to work together to make a transaction.

Once your customer has placed an order, the payment gateway verifies the customer’s card details and checks if they have enough funds in their account to pay you.

How To Choose Right Payment Gateway For Your Business?

As managing payments is an essential part of the success of any business, choosing the right payment gateways is an important decision to make.

Here are the Factors you need to consider when choosing a Payment Gateway:

Payment Security: A secure payment system will also reassure your clients and strengthen their trust in your company.

Customer Support: Your payment service provider must always be reachable and have a quick turnaround when addressing customer payment-related concerns.

Processing Speed: The payment gateway should ensure that all customers have smooth transactions and that nobody has prolonged downtime or other problems with payment processing.

Quick & Easy Integration: Make sure the payment gateway provider you select has a simple onboading and integration process that doesn’t take long.

Pricing: Make sure the payment gateway provider you choose delivers the most value for your money and meets your budget requirements.

Top 10 Payment Gateways in India for 2023

Here is the list of the top 10 payment gateways in India for 2023 you must know. Have Look 😎

As managing payments is an essential part of the success of any business, choosing the Cashfree Payment Gateways is an Right decision.

💪Features

Activity Dashboard

Customisable Report

Data Import/Export

Data Security

Debit/Credi Card Processing

🤩Pros

120+ Payment Options

Good Customer service

😰Cons

Relatively expensive

Delayed communication

PayU Payment Gateways is Inida’s Leading Payment solution provider, serving over 5 lakh businesses. PayU enable businesses to collect online and offline payments vai 150+ payment methods, including Credit Cards, Debit Card, Net Banking, EMIs, BNPL, QR, UPI, Wallets, and More.

💪Features

ACH payment processing

Activity dashboard

Billing and Invoicing

Compliance management

🤩Pros

Good Customer Support

Easy Integration

Razorpay Payment Gateways is an indian payments solution that enables businesses to accept, process, and disburse payments through its product suite.

it gives you to all payment method, including credit and debit card, net banking, UPI, and other popular wallets.

💪Features

100+ payment options

PCI DSS compliant

Dashboard reporting

Recurring/ subscription billing

🤩Pros

Comprehensive API documentation

Quick and easy to set up

😰Cons

Only domestic currencie support

No standard process for onboarding

Slow account activation

4. Paykun

The Paykun payment gateway caters to enterprises, SMEs, NGOs, eCommerce brands, and many other sectors. The payment solution is a mobile-optimized website, which caters to QR transactions, along with other default methods. PayKun offers single-click easy refund, payment failure downtime options, and subscription payment methods to merchants.

💪Features

Merchant Dashboard

UPI Autopay

QR-Based Payments

Invoice Payments

🤩Pros

Instant Settlement

120+ Payment Options

1 hour approvals and onboarding time

5. PayG

PayG Payment Gateways is a customized, Fully integrated, Omni channel Payment Solutions Provider that will assist your business in growing by easily and securely collecting payments from customers vai any device in any mode.

💪Features

Merchant Dashboard

UPI Autopay

QR-Based Payments

Invoice Payments

🤩Pros

Simple and Smooth transactions

Good Customer Service

😰Cons

Increased Payment Failures

Confusing Onboarding Process

6. Paytm

Paytm Payment Gateways is a Noida-based Provider of financial services and digital payments. it’s a mobile e-commerce site that serves as the go-to place for quick online recharges, DTH, data card and Metro card recharges, as well as quick payments for mobile bills.

💪Features

Recharge and pay bills

Book travel tickets

Book entertainment tickets

Secure and Fast

🤩Pros

Smooth transactions

Multipal payment options

7. Mobikwik

MobiKwik Payment Gateways is one of india’s largest mobile wallets and Buy Now Pay Later (BNPL) players. Compining the ease of regular mobile payments with the advantages of BNPL, it aims to satisfy the unmet credit demands of the rapidly expanding digital payment user base.

💪Features

Accounting Software Intergration

Reporting / Dashboards

Accepted Credit Cards and Debit Cards

ACH Payments and eCheak Processing

🤩Pros

PCI DSS compliance

Fraud Protection Tools

8. Easebuzz

Easebuzz Payment Gateways is a software-enabled payment platform that helps SMEs with digital payments and offers reliable payment solutions that can help them grow their business seamlessly in the market.

💪Features

Billing and Invoicing

Data Security

Credit/Debit Cards Processing

Cryptocurrency Processing

🤩Pros

Simple and Easy-to-use Payment APIs

PCI DSS Secure

9. Paypal

Users of PayPal can send money to friends, family, coworkers, and more quickly and easily. You must first create an account to use paypal to send and receive money. PayPal Payment Gateways accounts can be created at no cost with just an email address.

💪Features

Multiple currency support

Interactive UI

Invoicing

Cloud integration

🤩Pros

Easy and straight forward to use

Encrypts all data and keeps info safe

10. CC Avenue

CC Avenue Payment Gateways is one of the largest payment gateways providers, with thousands of marchants on board and a presence in south Asia and india, Providing Multi-Currency, Multiple payment option Online payments processing services.

💪Features

Easy Integration

Responsive transaction page

Real-time Authorisation

Secure and Fast

🤩Pros

Smooth transactions

Various Pricing Plan

😰Cons

Delayed Settlements

High failures in International Transactions

Bad Customer Support

Read More About

Conclusion

This was our list of the top 10 Payment Gateways in india for the upcoming year . As technological advancements keep increasing, you should ensure that your business is integrated with emering technologies.

A payment gateways ensure safe and secure transaction for both your business and its customers. Make sure you choose a payment gateways with all the features mentioned above for smooth running of your business.

Thanks For Reading 🥰